Read Time

5 mins

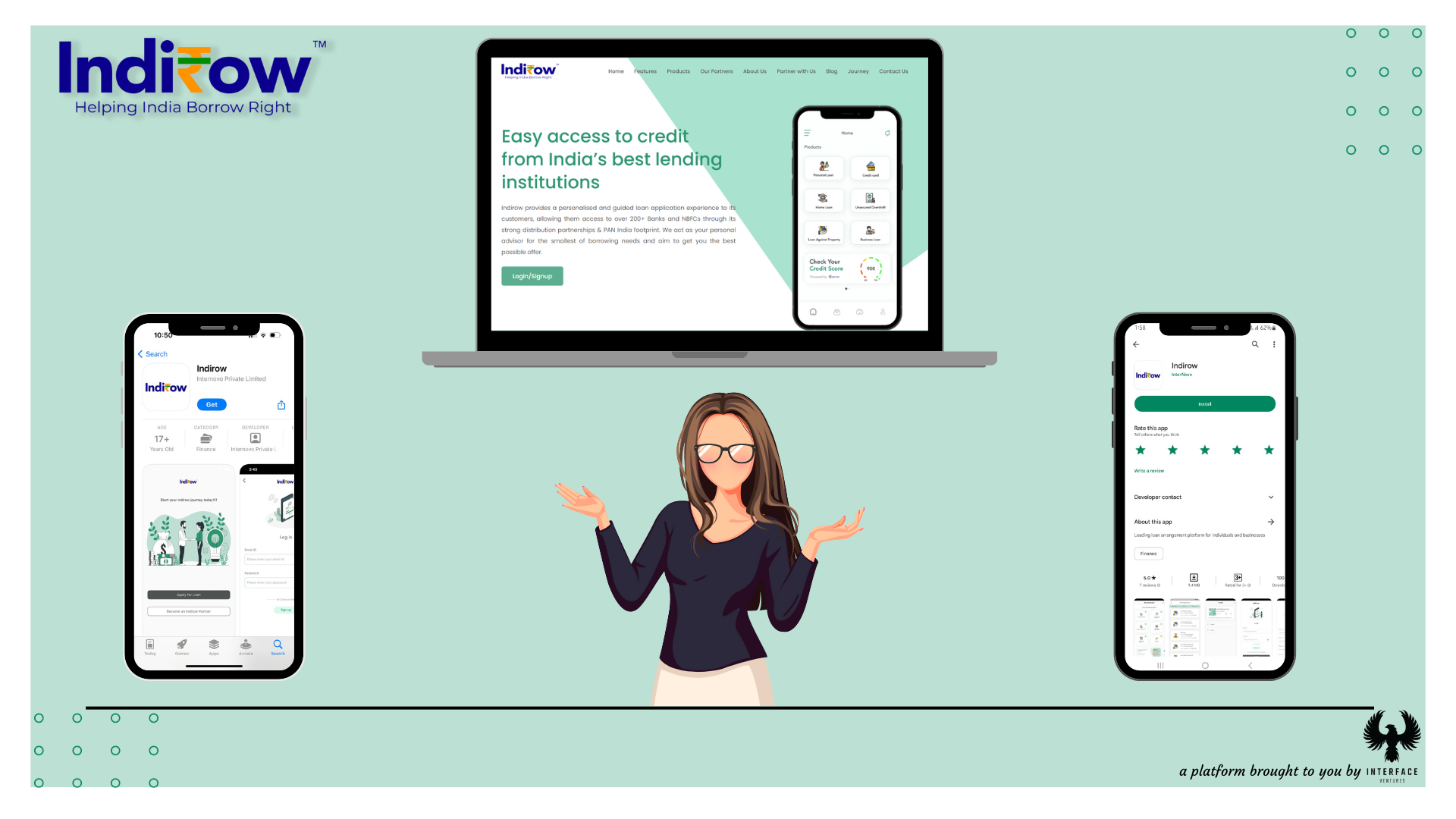

How Indirow Is Making Borrowing Simple for Everyone ?

The Best Loan App

Written by

Indirow

Introduction

In today's fast-paced world, financial emergencies can strike at any time. Whether it's for medical expenses, education, home renovation, or a dream vacation, having access to easy and fast loans has become essential. Indirow, the best loan app, is revolutionizing the lending landscape by providing a personalized and guided loan application experience to its customers. With a strong presence across India and partnerships with over 200+ Banks and NBFCs, Indirow is your trusted personal advisor for all your borrowing needs. Let’s explore how Indirow is simplifying the borrowing process and making loans accessible to everyone.

The Convenience of Indirow Personal Loans

Indirow offers personal loans that are tailored to your specific needs. Whether you need a loan for a medical emergency or a dream wedding, we have got you covered. The best part is that the application process is incredibly easy and fast. You can apply for a personal loan from the comfort of your home using the Indirow app or website. With just a few clicks, you can initiate the loan application process, eliminating the need for time-consuming visits to a physical bank.

Indirow's Wide Network of Lenders

One of the standout features of Indirow is its extensive network of lending partners. Indirow has partnered with over 200+ Banks and Non-Banking Financial Companies (NBFCs), ensuring that you have a wide range of loan options to choose from. This network of lenders means that you are more likely to find the best possible loan offer tailored to your specific financial situation and requirements.

Personalized Loan Guidance

Indirow goes beyond being just a loan aggregator. It acts as your personal advisor for all your borrowing needs. The app's algorithms are designed to understand your financial profile, preferences, and borrowing capacity, helping you make informed decisions. This personalized guidance ensures that you are offered loans that are suitable for your unique circumstances.

Transparent and Competitive Interest Rates

One of the key factors to consider when taking out a loan is the interest rate. Indirow is committed to providing transparent and competitive interest rates, ensuring that you understand the terms and conditions of your loan clearly. This transparency is crucial in helping you make the best borrowing decision.

PAN India Presence

Indirow's PAN India presence ensures that no matter where you are in the country, you can access their services. This extensive reach means that borrowers from different regions can benefit from Indirow's personalized loan solutions, making it easier for everyone to access the best loan offers.

Hassle-Free Application Process

Indirow has designed its loan application process to be hassle-free. Here's a step-by-step guide on how to apply for a loan using the Indirow app:

-

Download the Indirow app or visit their website.

-

Create an account and provide your personal and financial details.

-

Select the type of loan you need and specify the loan amount and tenure.

-

Submit the necessary documents, which can be uploaded digitally.

-

Indirow's backend team will analyze your information and place your file with the suitable lenders across India .

-

Once lender verifies and approve your file, the funds are disbursed to your bank account.

Quick Loan Disbursement

Indirow understands that when you need a loan, time is of the essence. That's why they ensure a quick loan disbursement process. Once your loan is approved, you can expect the funds to be transferred to your bank account in a matter of days, allowing you to address your financial needs without delay.

Service is free of cost

Indirow offers a no-cost service that provides customers with a tailored and guided loan application process. With an extensive network of over 200+ Banks and Non-Banking Financial Companies (NBFCs), Indirow leverages strong distribution partnerships and a PAN India presence. Acting as a personal advisor, Indirow assists customers in securing loans for various borrowing requirements, striving to secure the most favorable loan offers.

User-Friendly Interface

The Indirow app and website feature a user-friendly interface, making it easy for borrowers to navigate the platform. Whether you are tech-savvy or not, you can easily apply for a loan, track your application's status, and access customer support whenever you need assistance.

Conclusion

Indirow, the best loan app, is reshaping the borrowing landscape in India. With its easy and fast loans, personalized loan guidance, and extensive network of lenders, it's clear that Indirow is making borrowing simple for everyone. Whether you have a specific financial need or simply want to explore loan options, Indirow has got you covered. Their commitment to transparency and competitive interest rates makes them a trustworthy choice for borrowers across the country. So, download Indirow now and make your next borrowing experience hassle-free and efficient by choosing Indirow